FAQs

FAQs Frequently Asked Questions

What is TrueBusiness iService?

TrueBusiness iService simplifies business operations for corporate customers, allowing easy account and service management. Users can track transactions, monitor usage, download reports, and handle billing and payments securely online. This efficient and secure solution minimizes paperwork and streamlines workflows, supporting all business needs with its “One Stop Self-Service” model.

Key Features of TrueBusiness iService for True Corporate Customers

- Convenient - Manage your business effortlessly from anywhere at anytime.

- Easy - User-friendly with flexible tools to meet your business needs.

- Secured - Strong encryption and verification for enhanced data safety.

- Fast - Quickly monitor and manage your usage in real time.

- Sign up for TrueBusiness iService Click here

- Registration & User Guide for TrueBusiness iService Click here

What is TrueBusiness iService?

Step to Register

Payment options for corporate customers

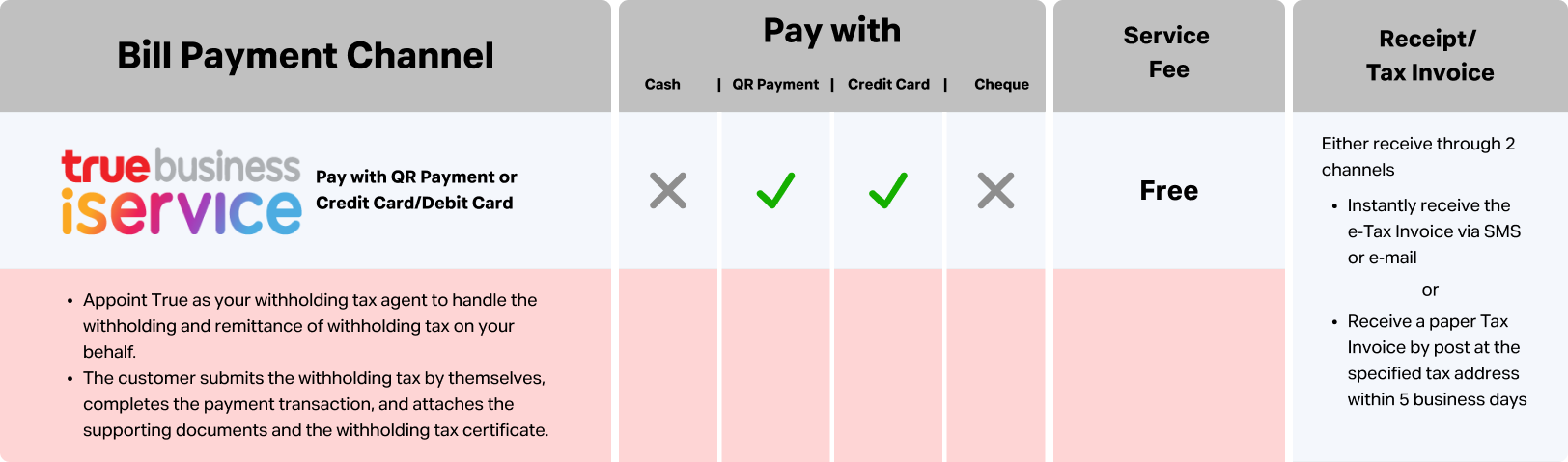

Pay online easily with TrueBusiness iService. Receive your e-receipt instantly and handle withholding tax effortlessly. Just register, activate e-Bill and e-Tax, and start paying through TrueBusiness iService

For customer who appoint True as a withholding tax agent or handle withholding tax submissions themselves.

Pay via True Business iService — Quick Guide

- Register and log in

- Log in with the registered email.

- For business customers with 1 TrueMove H number, you can register and verify with an OTP — no documents needed.

- For customers with multiple numbers or other True products, complete the registration process first (if not already registered).

-

Go to “Bills & Payment” and choose a payment method

- Pay via PromptPay QR Code

- Pay via Credit/Debit Card

2.1 Paying with PromptPay QR Code- Select up to 50 bills, total not exceeding THB 150,000/transaction

- Search bills by product, branch name/number, or account name/number.

- Tap Create PromptPay QR Code → scan to pay.

- After successful payment, the screen will show confirmation, and you can view payment history anytime.

2.2 Paying with Credit/Debit Card- Select up to 50 bills, total not exceeding THB 25,000. Supports VISA, Mastercard, and JCB.

- Search bills by product, branch name/number, or account name/number.

- Enter card details or save the card for future use.

- Payment confirmation will appear on screen.

- Receive receipt/tax invoice.

- Instantly receive e-Receipt/e-Tax instantly via SMS/email (if subscribed). Otherwise, receive the physical document by mail within 5 business days.

- Get a receipt / tax invoice Receive instantly via SMS/email as an e-Tax invoice upon registration, or within 5 business days by mail.

- Required documents and details

- Bill statement, service number, or account number

- Original withholding tax certificate

- Payment amount

- If the customer submits the withholding tax: pay the net amount after withholding tax deduction.

- If True is appointed as the withholding tax agent: pay the full invoice amount. True will remit the withholding tax on your behalf.

- Receive the Receipt/Tax Invoice immediately

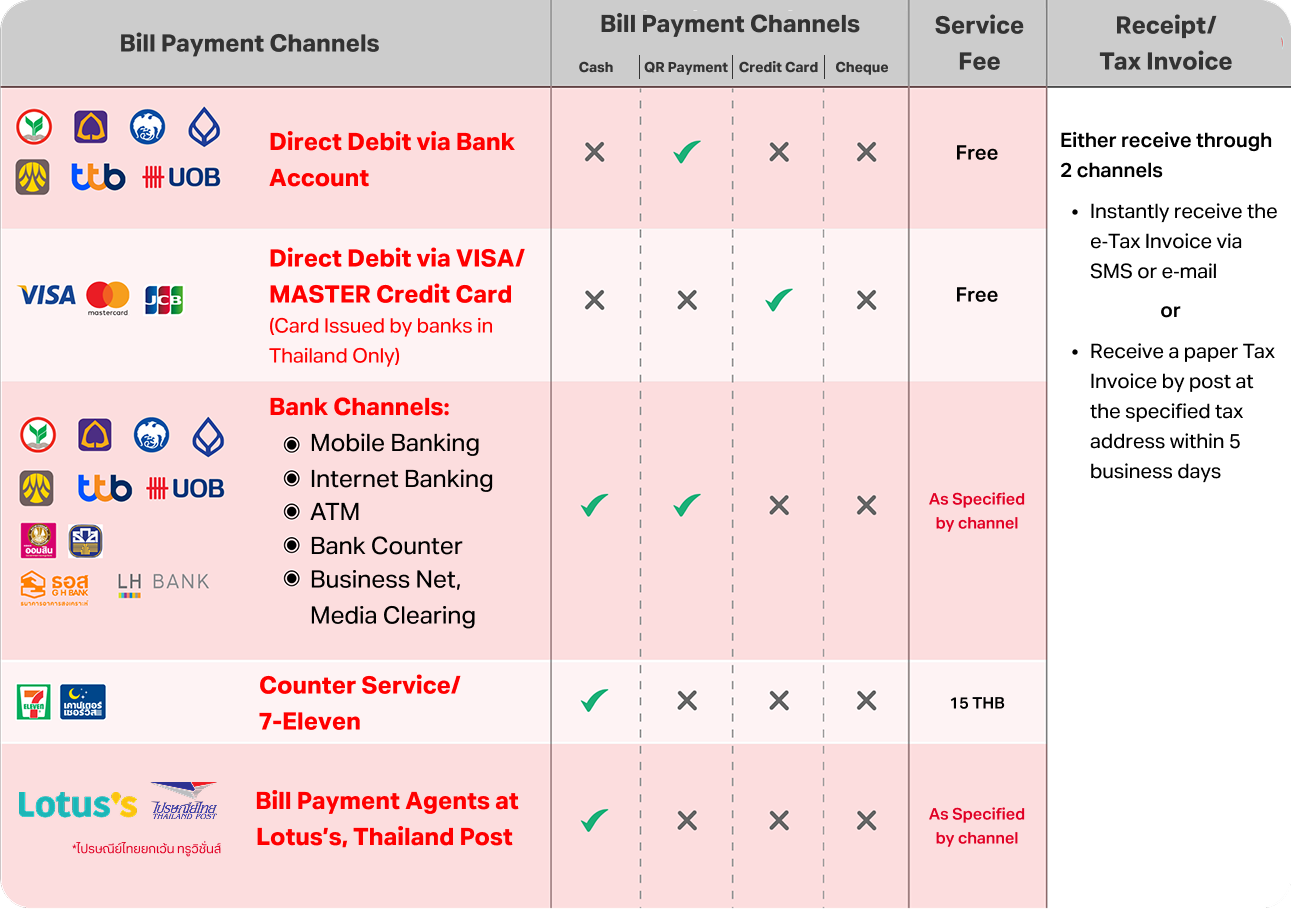

Automatic Bank Account / Credit Card Payment

- Credit Card Auto‑Payment

Submit the application via email to truebusiness1239@truecorp.co.th or at any True Shop nationwide. Enterprise customers may submit documents through their account executive officer.

- Bank Account Auto‑Payment

Submit the application form at any convenient bank branch. Enterprise customers may submit documents through the bank counter or their account executive officer.

- Payment Amount

The full invoice amount will be deducted from your bank account or credit card.

- Receipt / Tax Invoice

You will receive an electronic receipt/tax invoice immediately after payment posting via SMS or email, or by post to your billing address within 5 business days.

Note for companies authorizing a representative.

Please attach:

- Power of Attorney signed by the authorized director with company seal and a THB 30 duty stamp

- Copy of the authorized director’s ID card (signed and certified)

- Copy of the authorized representative’s ID card (signed and certified)

Appoint true as a withholding tax agent

How to appoint True as your withholding tax agent

- Download the Withholding Tax Agent Appointment Agreement

- Complete the appointment section, have it signed by an authorized director, apply the company seal, and attach the document detailing the request for payment of stamp duty in cash for electronic instruments (Form A.S.9) and Send the application to truebusiness1239@truecorp.co.th with the subject line: Application for Appointment of True as Withholding Tax Agent, including the Business ID, Taxpayer Identification Number, or Company Name.

- Processing Time: The appointment will take effect within 5 business days (applicable to all services under the service type specified under specified Business ID in the appointment form).

- Keep the original document with the customer.

- Upon completion of the company's procedures, a fully executed copy of the agent appointment agreement will be sent back to the client via the email address specified in the agreement.

- Download the Withholding Tax Agent Appointment Agreement by service type TrueMove H (TH), True Online (TH), True Visions (TH), TrueMove H (Eng), True Online (Eng), True Visions (Eng)

- Example of filling out the “Withholding Tax Agent Appointment Agreement”. (Download here)

- Guidelines for requesting e-stamp duty (Form A.S.9) (Download here) and an example of the document detailing the request for payment of stamp duty in cash for electronic instruments. (Download here)

- Electronics Receipt / Tax Invoice: Click to view the sample

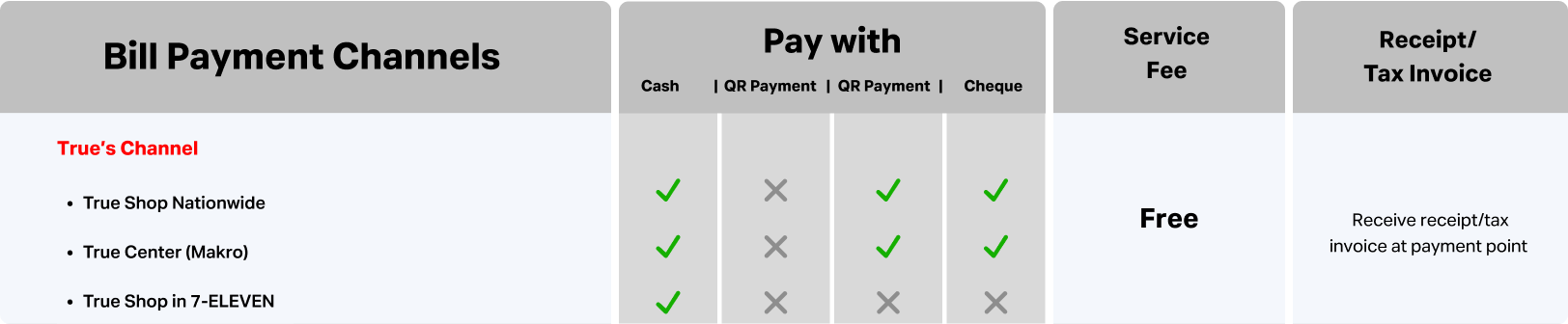

- Find True Shop, True Center at Makro, and True Shop at 7-Eleven near you: Click here

- New withholding tax rate of 3% for service payments effective October 1, 2020: Click here

How can TrueBusiness customers pay bills at True Shop in 7-Eleven

TrueBusiness offers convenient bill payment for corporate customers at True Shop in 7-Eleven. Pay with cash, credit cards (all branches), or cheques (only at 125 branches in Bangkok). Service is available from 10:00 AM to 5:00 PM.

How to pay your bill

- Have your billing invoice and withholding tax certificate ready.

- Pay with cash, credit card, or cheque and instantly receive your receipt/tax invoice.

Note: Enjoy greater convenience for customers who appoint True to withhold and remit taxes, payments can be made at banks,

all Counter Service branches, and these channels. Click here

FOR MORE INFORMATION

Let’s Connect

Call Center

1239

Contact Us for Details

SUBMIT INQUIRY